Portfolio software

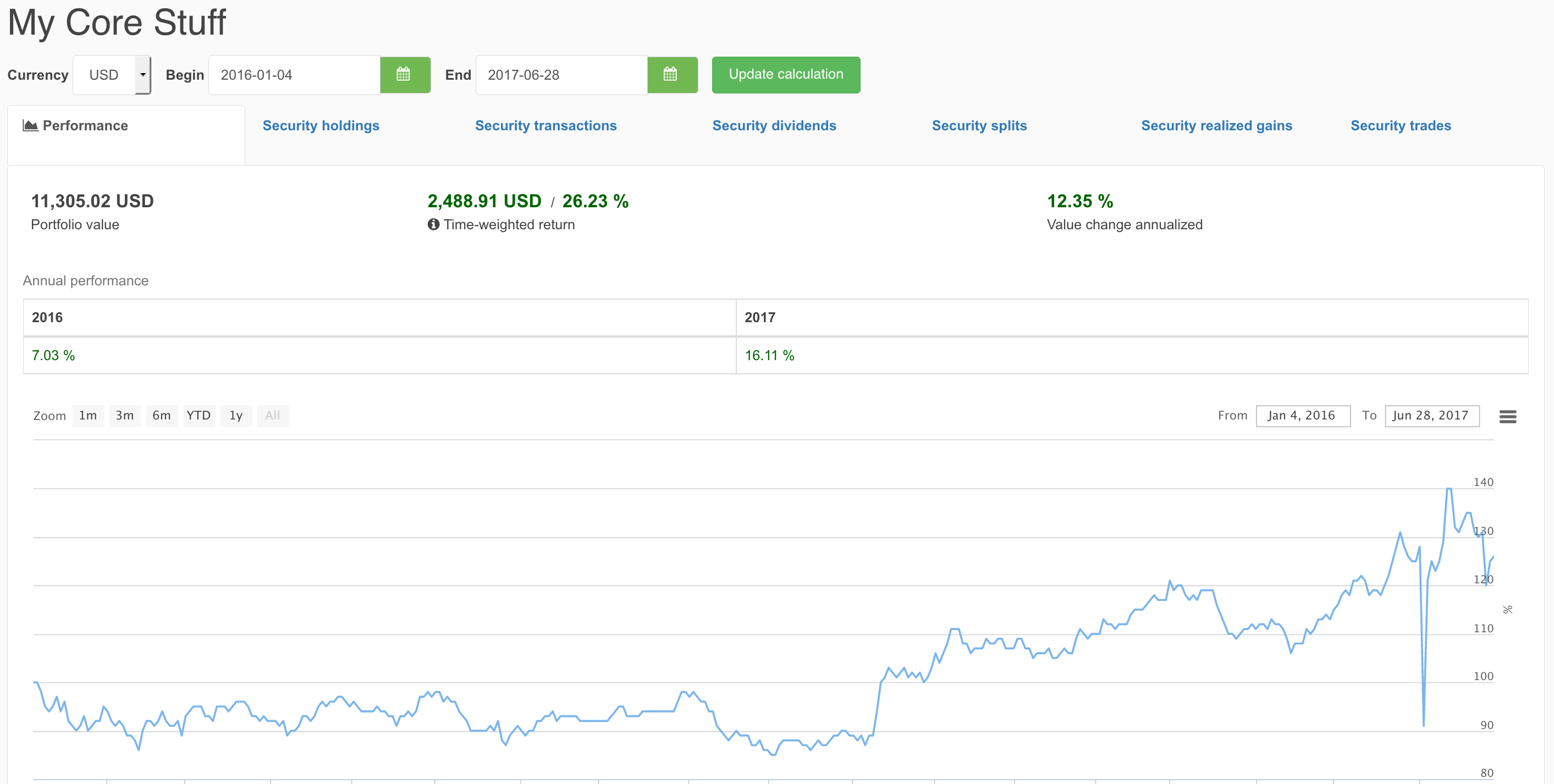

My portfolio software is built for tracking investment portfolios. The software brings value to everyone interested about tracking the ROI-% of their portfolio. Portfolio software also calculates annual and annualized ROI-%, along with individual investment ROI-%.

Why portfolio tracking is important?

So, why calculating portfolio ROI-% is important? Investors making allocation decisions often compare average returns between different asset classes when they make decisions where to invest. Tracking investment returns is therefore important for investors trying to maximize their ROI-%. If realized annualized returns for investors are not meeting their targets, they might want to reconsider portfolio allocation, or consider trying different investment products. Comparing portfolio ROI-% to some benchmark, like stock index, helps investors to decide if they should make chances to their portfolio to achieve chosen targets.

The portfolio software is built to be quite flexible with regards to portfolio contents. Portfolios consisting of property or land/forest investments could be easily added to software with little modification. Out of the box the software is built with support for stocks, currencies and cryptocurrencies. Almost any type of investment could be tracked as long as suitable price information can be obtained for investment duration.

Story

I got working with the portfolio software, when I realized there are not that many suitable services on the market that can show my aggregate investment ROI-% over different brokers and markets. Portfolio trackers of specific brokers only show the returns of investments made in their own service. Moreover, many foreign services have price data for US/British/German/etc. stocks, but lack them for Finnish/Swedish stocks.

So I started working on software of my own, that I could tailor to my needs. I quickly realized this kind of software would bring value to many persons, who’d like to have a single service to track all their investments. Many investors are running their custom Excel spreadsheets. This kind of software would do the tracking for them.

Additional Features

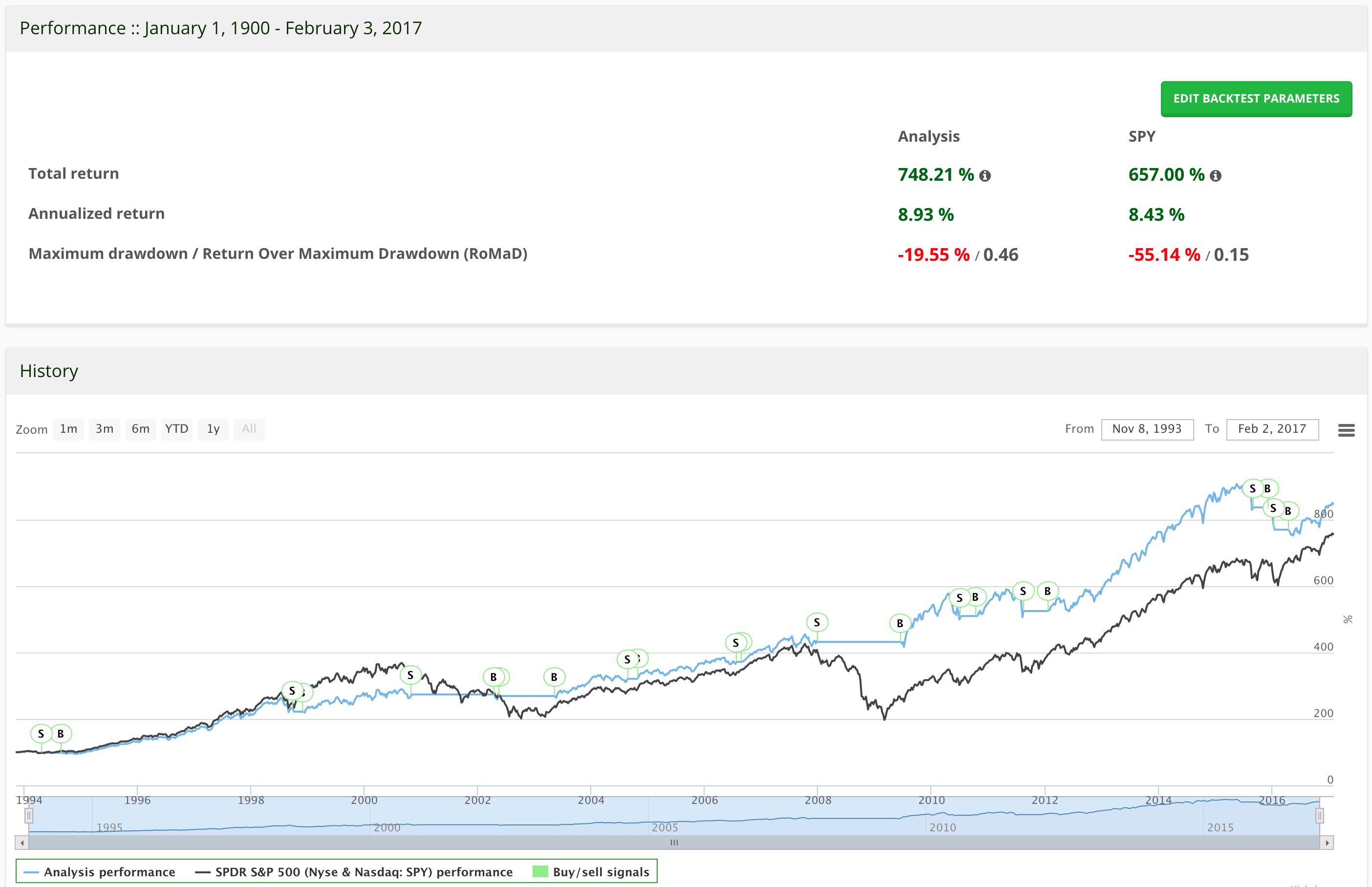

Backtesting tool

Backtesting tool helps everyone who would like to backtest their investment strategies. User can simulate investment strategy by generating buy/sell signals according to signal conditions. The tool supports automated backtesting for wide variety of investment assets supported by Salkku platform, along with stocks, fiat currencies and cryptocurrencies. The tool calculates ROI-% for the investment strategy and allows to compare the results with some existing benchmark.

Further details

Working demo of the software is online at https://salkku.co.